Select the study name below for fielding, publish, and press release dates as well as award information, if applicable. We recommend that you bookmark this page and check back for the latest information.

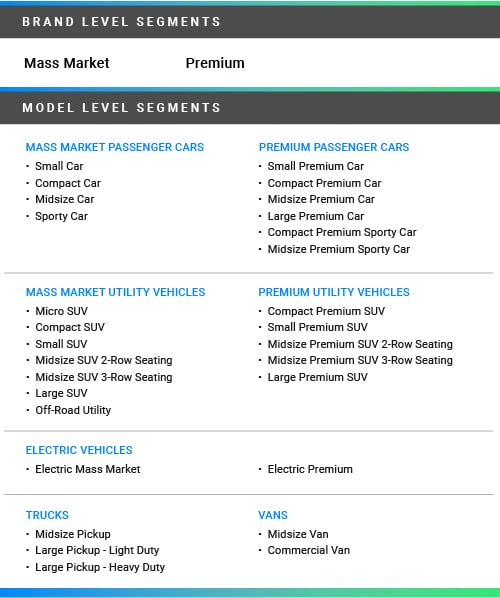

The J.D. Power Initial Quality Study (IQS) serves as the industry benchmark for new-vehicle quality measured at 90 days of ownership and has proven to be an excellent predictor of long-term reliability, which may significantly impact new-vehicle purchase decisions. The focus of the study is model-level performance and comparison of individual models to similar models in respective segments, which helps automakers worldwide to design and produce higher-quality vehicles that exceed owners’ expectations.

2024 Key Dates:

Survey Fielded: July 2023 - May 2024

Publish: June 25, 2024

Press Release: June 27, 2024

Read the 2023 IQS Press Release >

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

For IQS, awards will be presented in the following categories for the brands and models that attain the highest level of initial quality and meet J.D. Power’s predetermined research criteria.

In addition, the following awards will be presented to vehicle manufacturing plants:

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

View 2024 Vehicles Profiled by Segment >

(Updated 12/12/2023)

The J.D. Power Automotive Performance, Execution and Layout (APEAL) Study examines new-vehicle owners’ assessments of their experiences with the design, content, layout, and performance of their new vehicle after 90 days of ownership. The study data provides insight on quality and design satisfaction.

APEAL is based on more than 40 vehicle attributes in 10 experience groups:

• Walking up to your vehicle

• Setting up and starting your vehicle

• Getting in and out of the vehicle

• Your vehicle’s interior

• Your vehicle’s performance

• Your vehicle’s driving feel

• Your vehicle keeping you safe

• Using the infotainment system

• Your vehicle’s driving comfort

• Fuel usage

2024 Key Dates:

Survey Fielded: July 2023 - May 2024

Publish: July 23, 2024

Press Release: July 25, 2024

Read the 2023 APEAL Press Release >

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

For APEAL, awards will be presented in the following categories for the brands and models that attain the highest level of overall APEAL and meet J.D. Power’s predetermined research criteria.

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

View 2024 Vehicles Profiled by Segment >

(Updated 12/12/2023)

The J.D. Power Tech Experience Index (TXI) Study measures problems encountered and the user experience with advanced technologies as they first enter the market, affording automakers time to address any problem areas before the technologies enter the “mass availability” stage.

2024 Key Dates:

Survey Fielded: July 2023 - May 2024

Publish: August 21, 2024

Press Release: August 22, 2024

Read the 2023 TXI Press Release >

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

For TXI, awards will be presented in the following categories for the brands and models providing the best-in-class tech experience and that meet J.D. Power’s predetermined research criteria.

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

View 2024 Vehicles Profiled by Segment >

(Updated 12/12/2023)

EV Consideration by:

--- Geography

--- Demographics

--- Vehicle Experience

--- Lifestyle

--- Psychographics

Analysis of Reasons for EV Rejection

Model-Level EV Consideration Details including:

--- Cross-Shopping

--- “Why Buy” Findings

EVC subscribers also receive Monthly Pulse deliverables providing up-to-date access to EV industry and model-level metrics, along with highlights on marketplace trends and developments.

2024 Key Dates:

Survey Fielded:

Client Publish: May 15, 2024

Press Release: May 16, 2024

Read the 2023 EVC Study Press Release >

Press Release & Award Information:

J.D. Power will issue a national press release that will highlight key findings and trends from the study.

Profiled Brands: N/A

(Updated 12/05/2023)

Click the links below to learn more about our three Electric Vehicle Experience (EVX) studies:

The J.D. Power Electric Vehicle Experience (EVX) Ownership Study, driven by PlugShare, sets the standard for benchmarking EV owner satisfaction with the critical attributes that affect the EV ownership experience. From the cost of ownership, problems experienced, vehicle service experience to driving habits and range, and ease of charging, this study provides a comprehensive assessment of consumer experiences with their with battery electric and plug-in hybrid electric vehicles. These experiences will strongly affect owners’ likelihood to repurchase an EV and recommend an EV to others. These key behaviors and insights into current EV ownership will help OEMs assess where they rank, who is doing it best, and why.

2024 Key Dates:

Wave 1:

Survey Fielded: July-December 2023

Client Publish: February 22, 2024

Press Release: February 27, 2024

Wave 2:

Survey Fielded: January - June 2024

Client Publish: July 30, 2024

Press Release: N/A

Read the 2024 EVX-Ownership Press Release >

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

Brands Intended to be Profiled in the 2024 Study:

Mass Market EV

Chevrolet Blazer EV

Chevrolet Bolt EUV

Chevrolet Bolt EV

Chevrolet Equinox EV

Chevrolet Silverado EV

Chevrolet Spark EV

Fiat 500e

Fisker Ocean

Ford F-150 Lightning

Ford Focus BEV

Ford Mustang Mach-E

Ford Transit Cargo EV

GMC Hummer EV

GMC Sierra EV

Honda Fit EV

Honda Prologue

Hyundai IONIQ 5

Hyundai IONIQ 6

Hyundai Kona EV

Kia EV6

Kia EV9

Kia Niro EV

Kia Soul EV

Lordstown Endurance

Mazda MX-30

MINI Cooper Electric

Nissan Ariya

Nissan LEAF

Rivian R1T

Subaru Solterra

Tesla Cybertruck

Toyota bZ4X

Toyota bZ5X

Toyota RAV4 EV

VinFast VF8

VinFast VF9

Volkswagen e-Golf

Volkswagen ID.4

Volkswagen ID.Buzz

Mass Market PHEV

Chrysler Pacifica Plug-In Hybrid

Dodge Hornet Plug-In Hybrid

Ford C-Max Energi

Ford Escape Plug-In Hybrid

Ford Fusion Energi

Honda Accord Plug-In Hybrid

Hyundai Santa Fe Plug-In Hybrid

Hyundai Sonata Plug-In Hybrid

Hyundai Tucson Plug-In Hybrid

Jeep Grand Cherokee 4xe

Jeep Wrangler 4xe

Kia Niro Plug-In Hybrid

Kia Optima Plug-In Hybrid

Kia Sorento Plug-In Hybrid

Kia Sportage Plug-In Hybrid

Mazda CX-90 Plug-In Hybrid

MINI Countryman Plug-In Hybrid

Mitsubishi Outlander Plug-In Hybrid

Subaru Crosstrek Plug-In Hybrid

Toyota Prius Prime

Toyota RAV4 Prime Plug-in Hybrid

Premium EV

Audi e-tron

Audi e-tron GT

Audi Q4 e-tron

Audi Q8 e-tron

BMW i4

BMW i7

BMW iX

Cadillac LYRIQ

Genesis Electrified G80

Genesis Electrified GV70

Genesis GV60

GMC Hummer EV SUV

Jaguar I-Pace

Lexus RZ

Lucid Air

Maserati GranTurismo Folgore

Maserati Grecale Folgore

Mercedes-Benz B-Class Electric Drive

Mercedes-Benz EQB

Mercedes-Benz EQE

Mercedes-Benz EQE SUV

Mercedes-Benz EQS

Mercedes-Benz EQS SUV

Polestar 2

Polestar 3

Porsche Taycan

Rivian R1S

Tesla Model 3

Tesla Model S

Tesla Model X

Tesla Model Y

Volvo C40 Recharge

Volvo EX90

Volvo XC40 Recharge

Premium PHEV

Audi A3 e-tron

Audi A7 Plug-in Hybrid

Audi A8 Plug-in Hybrid

Audi Q5 Plug-in Hybrid

Bentley Flying Spur Plug-In Hybrid

BMW 3 Series Plug-In Hybrid

BMW 5 Series Plug-In Hybrid

BMW 7 Series Plug-In Hybrid

BMW X3 Plug-In Hybrid

BMW X5 Plug-In Hybrid

BMW XM

Cadillac CT6 Plug-In Hybrid

Cadillac ELR

Jaguar F-Pace Plug-In Hybrid

Land Rover Range Rover Plug-In Hybrid

Land Rover Range Rover Sport Plug-In Hybrid

Land Rover Range Rover Velar Plug-In Hybrid

Lexus NX Plug-In Hybrid

Lincoln Aviator Plug-In Hybrid

Lincoln Corsair Plug-In Hybrid

Mercedes-Benz C-Class Plug-In Hybrid

Mercedes-Benz GLC Plug-In Hybrid

Mercedes-Benz GLE Plug-In Hybrid

Mercedes-Benz S-Class Plug-In Hybrid

Polestar 1

Porsche 918

Porsche Cayenne Plug-In Hybrid

Porsche Panamera Plug-In Hybrid

Volvo S60 Plug-In Hybrid

Volvo S90 Plug-In Hybrid

Volvo V60 Plug-In Hybrid

Volvo V90 Plug-In Hybrid

Volvo XC40 Plug-In Hybrid

Volvo XC60 Plug-In Hybrid

Volvo XC90 Plug-In Hybrid

_____________

The J.D. Power Electric Vehicle Experience (EVX) Home Charging Study, driven by PlugShare, captures consumer attitudes, behaviors, and satisfaction, setting the standard for benchmarking home charging station performance. As a means to explore the reasons behind EV customers’ home charging behaviors and attitudes, the study includes insight into when the charging station was bought, what brand was purchased, how it was installed, how the charging station is used, utility programs offered, consumers’ charging habits and their overall satisfaction. Additionally, the study investigates the likelihood of Level 1 charger users to upgrade to a faster charger.

2024 Key Dates:

Survey Fielded: November 2023 - January 2024

Client Publish: March 20, 2024

Press Release: March 26, 2024

Read the 2024 EVX-Home Charging Press Release >

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

For the EVX Home Charging Study, J.D. Power will present an award to the EV home charging provider that ranks highest in the study.

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

2024 Profiled Brands:

EV Charger Brand (includes level 1 OEM chargers)

Accell

Amazon

AMPRoad

Audi

Autel

Blink

BMW

Bosch

BougeRV

Cadillac

ChargePoint

ChargifyEV

Chevrolet

Chrysler

ClipperCreek

Delphi

Delta

Duosida

Eaton

Electrify America

ElectvLife

Emporia

Ergmaster

EVBase

EVCars

EVoCharge

Fiat

Fisker

FLO Home

Ford

GE

Genesis

GMC

GRIZZL-E

Hansshow

Honda

Hyundai

J+ Booster

Jaguar

Jeep 4xe

JuiceBox

Keruida

Kia

Land Rover

Lectron

Lefanev

Leviton

Lexus

Lincoln

Lucid

Massimo Electric

MaxGreen

Mazda

Megear

Mercedes-Benz

MINI

Mitsubishi

Monadd

Morec

MrCartool

Mustart

NeoKit

Nissan

Nurzviy

OpenEVSE

PFCTART

PiOn

Polestar

Porsche

PRIMECOM

Pulsar

Rivian

RNOPWO

Roadi

Schneider

Schumacher

Scion

Shell

Siemens

smart

SplitVolt

Startway

Subaru

TeraHome

Tesla

TopDon

Toyota

TurnOnGreen

VeoryFly

Vevor

Volkswagen

Volvo

Wallbox

Webasto

Workersbee

Zencar

_____________

The quarterly J.D. Power Electric Vehicle Experience (EVX) Public Charging Study, driven by PlugShare, provides “in-the-moment” consumer behavior, attitudes and satisfaction with the experience of using EV public charging stations in this rapidly changing environment. This new study utilizes the PlugShare app to capture the public charging experience as it happens. The study offers a unique view into the overall experience with the use, location of the charger, convenience, speed, safety and payment processing, among other critical elements experienced by EV owners.

Additionally, when the experience does not go as planned and vehicle charging does not occur, the reasons for failure are further explored. Together, these insights will set the standard for benchmarking public charging station providers and drive improvement for a key component of EV market growth.

2024 Key Dates:

Survey Fielding

Q1: February - March 2024

Q2: April - June 2024

Q3: July - September 2024

Q4: October - December 2024

Client Publish

Q1: May 1, 2024

Q2: August 13, 2024

Q3: October 31, 2024

Q4: February 7, 2025

Press Release

Q1: N/A

Q2: August 14, 2024

Q3: N/A

Q4: N/A

Read the 2023 EVX-Public Charging Press Release >

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

For the EVX Public Charging Study, J.D. Power will aggregate the study data on an annual basis and present awards to the EV public charging providers that provide the highest levels of satisfaction.

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

2024 Profiled Brands:

DC Fast Charger

7Charge

AmpUp

Applegreen Electric

Autel

Blink

bp pulse North America

CalTrans

ChargeLab

ChargeNet

ChargePoint

ChargeShare

ChargeUP

Chargie

CircleK Charge

DirtRoad CSG

eCharge Network

Electrify America

Electrify Canada

Enel X

Energy Group - EVXY

Energy Hunters

EnviroSpark

EV Range

EVBolt

EVCS

EvGateway

EVgo

EvInstitute

EVoke

EVolution

EVolve NY

EVPassport

EVPower

EVsmart

EVStart

Flitway

FLO

Ford Charge

FPL EVolution

Francis Energy

FreeWire

Graviti Energy

Greenspot

InCharge

InCharge VattenFall

Innogy

Intertie

Jule

Liberty Plugins

Livingston Energy

Loop

Noodoe EV

OpConnect

PowerCharge

PowerFlex

Recargo Network

ReCharge Alaska

Red E

Revel

Rivian Adventure Network

Shell Recharge

Supercharger

SWTCH

TurnOnGreen

Universal EV

Volta

Wevo Energy

ZEF Energy

L2 Charging Station

7Charge

Adani

AmpedUp!

AmpUp

Applegreen Electric

Autel

Autocharge

Blink

CarCharging

Chargefox

ChargeLab

ChargePoint

ChargerQuest

ChargeShare

ChargeUP

Chargie

CircleK Charge

Circuit Electrique

DirtRoad CSG

eCharge Network

Electric Avenue

Electrify America

Enel X

Energy Group - EVXY

EnviroSpark

EOS Charge

Epic Charging

EV Initiative

EV Range

EV Spot Network

EVBolt

EVBox

EVBox B.V.

EVCS

EverCharge

EvGateway

EVgo

EvInstitute

Evium Charging

EVmatch

EVoke

EVolution

Evolve KY

EVPassport

EVsmart

EVStart

FLASH

FLO

FPL EVolution

Francis Energy

FutureEV

GE WattStation

Graviti Energy

GreenPark

Greenspot

Innogy

Intertie

Irvine Company

Ivy

JuiceBar

Liberty Plugins

Livingston Energy

Loop

Noodoe EV

OK2Charge

OpConnect

Park + Charge

PowerCharge

PowerFlex

Powerport EVC

ReCharge Alaska

Red E

Rivian Adventure Network

Rivian Waypoints

Schneider Electric

Shell Recharge

Shorepower

Siemens eMobility

Stay-N-Charge

Sun Country

SWTCH

Tesla Destination

TurnOnGreen

Universal EV

Volta

Webasto

Wevo Energy

XEAL Energy

ZEF Energy

Zero Impact

Zevtron

(Updated 03/26/24)

The OEM EV App Report evaluates the user experience and best practices with automakers’ EV smartphone applications, providing a comprehensive, standardized assessment of EV mobile apps from 44 brands total representing the United States, Europe and China markets.

The study reviews apps from makes that offer Electric Vehicles (EVs). As EVs can offer more, and unique, use cases for the app, it is important for the user experience to align with the distinct EV customer requirements.

2024 Key Dates:

Study Publish: May 29, 2024

Press Release: May 29, 2024

Press Release & Award Information: J.D. Power will issue a national press release that will highlight key findings and trends from the study and include rankings of the EV Mobile Apps included in the study that meet J.D. Power’s predetermined criteria. The EV Mobile App that ranks highest and meets predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

2024 Award Eligible Brands:

Audi

BMW

Cadillac

Chevrolet

Fiat

Ford

Genesis

GMC

Hyundai

Jaguar

Kia

Lexus

Lucid

Mercedes-Benz

MINI

Nissan

Polestar

Porsche

Rivian

Subaru

Tesla

Toyota

Vinfast

Volkswagen

Volvo

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

2024 Profiled Brands:

China Profiled Brands:

Aion

Aito

Avatr

BYD

Deepal

Li Auto

NIO

Voyha

Xiaomi

Xiaopeng

Europe Profiled Brands:

BYD

Cupra

Lotus

MG

NIO

Opel

Renault

Skoda

Smart

(Updated 4/18/24)

The J.D. Power Sales Satisfaction Index (SSI) Study measures satisfaction with the sales experience among new-vehicle buyers and rejecters (those who shop a dealership and purchase elsewhere). Buyer satisfaction is based on six factors: dealer personnel; delivery process; working out the deal; paperwork completion; dealership facility; and dealership website. Rejecter satisfaction is based on five factors: salesperson; fairness of price; experience negotiating; variety of inventory; and dealership facility.

2024 Key Dates:

Study Fielding: June - September 2024

Study Client Publish: November 6, 2024

Study Press Release: November 7, 2024

Read the 2023 SSI Press Release >

Segmentation Changes: Beginning with 2023 U.S. CSI, the automotive retail benchmark studies (CSI and SSI) will introduce additional rankings and Awards to recognize performance based on vehicle needs and to help inform shopper decisions based on their specific model choices. The 2023 U.S. CSI and SSI Studies will now include the following ranking and Award segments:

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

For SSI, awards will be presented to the highest-ranked nameplate that meets all research and sample criteria in each segment below. Award claims will be worded as follows:

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

2023 Profiled Brands:

Mass Market

Buick

Chevrolet

Chrysler

Dodge

Ford

GMC

Honda

Hyundai

Jeep

Kia

Mazda

MINI

Mitsubishi

Nissan

Ram

Subaru

Toyota

Volkswagen

Premium

Acura

Alfa Romeo

Audi

BMW

Cadillac

Genesis

Infiniti

Jaguar

Land Rover

Lexus

Lincoln

Maserati

Mercedes-Benz

Polestar

Porsche

Volvo

(Updated12/05/2023)

The J.D. Power Aftermarket Service Index (ASI) Study measures the service experience but emphasizes customers with 4-10 years of vehicle ownership—a critical period during which vehicle warranty and most maintenance programs expire. The ASI Study focuses on the service experience with the aftermarket service providers in the Do it for Me (DIFM) market.

2024 Key Dates:

Survey Fielded: January - February 2024

Publish: April 25, 2024

Press Release: April 30, 2024

Read the 2023 ASI Press Release >

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

For ASI, awards will be presented to the aftermarket providers that rank highest in Full Service Maintenance & Repair, Quick Oil Change and Tire Replacement categories. Award claims will be worded as follows:

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

2024 Profiled Brands:

Tire

Belle Tire

Big O Tires

Costco

Discount Tire

Express Oil Change & Tire Engineers

Firestone Complete Auto Care

Goodyear Auto Service

Jiffy Lube

Les Schwab Tire Center

Mavis Discount Tire

Meineke Car Care Centers

Midas

Mr. Tire Auto Service Centers

NTB

Pep Boys

Sam's Club

Tires Plus

Walmart

Maintenance

Belle Tire

Brakes Plus

Christian Brothers Automotive

Firestone Complete Auto Care

Goodyear Auto Service

Les Schwab Tire Center

Mavis Discount Tire

Meineke Car Care Centers

Midas

Monro Auto Service and Tire Centers

Mr. Tire Auto Service Centers

Pep Boys

Tire Choice Auto Service Centers

Tires Plus

Oil

Express Oil Change & Tire Engineers

Grease Monkey

Jiffy Lube

Take 5

Valvoline Instant Oil Change

Walmart

(Updated 1/02/24)

The J.D. Power Automotive Brand Loyalty Study measures if a vehicle owner purchased the same brand after trading in an existing vehicle on a new vehicle purchase or lease. Only sales at new vehicle franchised dealers qualify. Our process utilizes the Power Information Network and its 16,000 affiliated dealers, which records vehicle trade and purchase data in the Dealer Management System.

2024 Key Dates:

Survey Fielded: September 2023 - August 2024

Release Date: September 2024

Read the 2023 ABLS Press Release >

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

For the Automotive Brand Loyalty Study, awards will be presented to the following vehicle segment categories:

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

(Updated 12/05/2023)

The J.D. Power Manufacturer Website Evaluation Study (MWES), conducted semi-annually, is designed to evaluate manufacturer websites from two perspectives: overall site function and the importance of various site features to online shoppers. The study provides insights into which current site functions and designs are most effective in helping shoppers narrow their consideration set and increase the likelihood to seriously consider a vehicle from that manufacturer.

2024 Key Dates:

MWES-Winter Study Fields: November 2023

MWES-Winter Study Publish: December 14, 2023

MWES-Winter Press Release: January 9, 2024

Read the 2024 MWES-Winter Press Release>

MWES-Summer Study Fields: May 2024

MWES-Summer Study Publish: July 11, 2024

MWES-Summer Press Release: July 16, 2024

Read the 2023 MWES-Summer Press Release>

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The press release will include rankings of the websites included in the study that meet J.D. Power’s predetermined criteria. The websites that rank highest and meet predetermined award criteria in the Premium brand and Mass Market brand segments will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

For MWES, J.D. Power will present an award to the websites that rank highest and meet predetermined award criteria in the Premium brand and Mass Market brand segments.

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

2024 Profiled Premium Brands:

Acura

Alfa Romeo

Audi

BMW

Cadillac

Genesis

Infiniti

Jaguar

Land Rover

Lexus

Lincoln

Maserati

Mercedes-Benz

Porsche

Tesla

Volvo

2024 Profiled Mass Market Brands:

Buick

Chevrolet

Chrysler

Dodge

Ford

GMC

Honda

Hyundai

Jeep

Kia

Mazda

Mini

Mitsubishi

Nissan

Ram

Subaru

Toyota

Volkswagen

(Updated 1/16/2024)

The J.D. Power Customer Service Index (CSI) Study measures satisfaction with service at a franchised dealer for maintenance or repair work among owners and lessees of one- to three-year-old vehicles. It also provides a numerical index ranking of the highest-performing automotive brands sold in the United States, which is based on the combined scores of five different measures that comprise the vehicle owner service experience. These measures are service quality; service initiation; service advisor; service facility; and vehicle pick-up.

The 2024 study will consist of owners of 2023, 2022 and 2021 model year vehicles who registered their vehicles in July-February of each calendar year.

2024 Key Dates:

Survey Fielded: August - December 2023

Client Publish Date: March 13, 2024

Press Release Date: March 14, 2024

Read the 2024 CSI Press Release >

Segmentation Changes: Beginning with 2023 U.S. CSI, the automotive retail benchmark studies (CSI and SSI) introduced additional rankings and Awards to recognize performance based on vehicle needs and to help inform shopper decisions based on their specific model choices. The 2024 U.S. CSI and SSI Studies will now include the following ranking and Award segments:

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

For CSI, awards will be presented to the highest-ranked nameplate that meets all research and sample criteria in each segment below. Award claims will be worded as follows:

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

2024 Brands Intended to be Profiled:

Overall Mass Market Brand

Buick

Chevrolet

Chrysler

Dodge

Ford

GMC

Honda

Hyundai

Jeep

Kia

Mazda

MINI

Mitsubishi

Nissan

Ram

Subaru

Toyota

Volkswagen

Mass Market Cars

Chevrolet

Chrysler

Dodge

Ford

Honda

Hyundai

Kia

Mazda

MINI

Mitsubishi

Nissan

Subaru

Toyota

Volkswagen

Mass Market SUVs/Minivans

Buick

Chevrolet

Chrysler

Dodge

Ford

GMC

Honda

Hyundai

Jeep

Kia

Nissan

Mazda

MINI

Mitsubishi

Subaru

Toyota

Volkswagen

Trucks

Chevrolet

Ford

GMC

Honda

Hyundai

Jeep

Nissan

Ram

Toyota

Overall Premium Brand

Acura

Alfa Romeo

Audi

BMW

Cadillac

Genesis

Infiniti

Jaguar

Land Rover

Lexus

Lincoln

Maserati

Mercedes-Benz

Porsche

Volvo

Premium Cars

Alfa Romeo

BMW

Acura

Audi

Cadillac

Genesis

Infiniti

Jaguar

Lexus

Lincoln

Maserati

Mercedes-Benz

Porsche

Volvo

Premium SUVs

Acura

Alfa Romeo

Audi

BMW

Cadillac

Genesis

Infiniti

Jaguar

Land Rover

Lexus

Lincoln

Maserati

Mercedes-Benz

Porsche

Volvo

(Updated 7/27/2023)

The J.D. Power Vehicle Dependability Study (VDS) focuses on problems experienced by original owners of 3-year-old vehicles. Study findings are used extensively by manufacturers worldwide to help them design and build better vehicles—which typically retain higher resale value—and by consumers to help them make more informed choices for both new and used vehicles.

Problem symptoms are evaluated in nine vehicle system categories:

2024 Key Dates:

Fielding: August - November 2023

Publish: February 6, 2024

Press Release: February 8, 2024

Read the 2024 VDS Press Release >

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

For VDS, awards will be presented in the following categories for the brands and models that attain the highest level of long-term vehicle dependability quality and meet J.D. Power’s predetermined research criteria.

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

View 2024 Vehicles Profiled by Segment >

(Updated 2/8/2024)

The OEM ICE App Report evaluates the user experience and best practices with automakers’ smartphone applications, providing a comprehensive, standardized assessment of vehicle mobile apps from roughly 30 makes.

2024 Key Dates:

Survey Fielded: N/A

Client Publish: December 2024

Press Release: December 2024

Read the 2023 ICE App Press Release >

Press Release & Award Information: J.D. Power will issue a national press release that will highlight key findings and trends from the study and include rankings of the internal combustion engine (ICE) Apps included in the study that meet J.D. Power’s predetermined criteria on December 6, 2023. The ICE App that rank highest and meets predetermined criteria in each award-eligible segment (Mass Market and Premium) will have the opportunity to leverage their award publicly through the J.D. Power award licensing program, which requires subscribing to the study as a prerequisite. Learn more

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

2023 Profiled Brands:

Acura

Alfa

Audi

BMW

Buick

Cadillac

Chevrolet

Chrysler

Dodge

Ford

Genesis

GMC

Honda

Hyundai

Infiniti

Jaguar

Jeep

Kia

Land Rover

Lexus

Lincoln

Mazda

Mercedes

MINI

Mitsubishi

Nissan

Porsche

Ram

Subaru

Toyota

Volkswagen

Volvo

(Updated 12/07/2023)

The J.D. Power Original Equipment Tire Customer Satisfaction Study measures new-vehicle owner satisfaction and quality experiences with their original equipment (OE) tires at one and two years of ownership. Measuring satisfaction during this two-year period enables usage analysis and loyalty data throughout the typical life cycle of original equipment tires. To measure customer satisfaction, critical-to-customer experience factors are examined using an index model. The model identifies the dominant factors that impact customer satisfaction and behavior for the industry and provides a benchmark of excellence for each.

2024 Key Dates:

Survey Fielding: August - December 2023

Client Publish: March 20, 2024

Press Release: March 25, 2024

Read the 2024 OE Tire Press Release >

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

For the Original Equipment Tire Satisfaction Study, awards will be presented to the highest-ranked tire brand in each of four vehicle-based tire segments: Luxury, Passenger Car, Performance Sport, and Truck/Utility. We’ll continue to rank brands based on the second year of ownership.

Award recipients are recognized in vehicle-based tire segments based on the different needs of customers in each segment. As a result, index weights for the index factors Tire Ride, Tire Traction/Handling, Tire Wear, and Tire Appearance are different for each of the four award segments.

Vehicle Segmentation:

Luxury

Compact Premium Car

Compact Premium SUV

Large Premium Car

Midsize Premium Car

Midsize Premium SUV

Small Premium Car

Small Premium SUV

Passenger Car

City Car

Compact Car

Compact MPV

Compact SUV

Large Car

Midsize Car

Midsize SUV

Minivan

Small Car

Small SUV

Performance Sport

Compact Premium Sporty Car

Compact Sporty Car

Midsize Premium Sporty Car

Midsize Sporty Car

Truck/Utility

Large Heavy Duty Pickup

Large Light Duty Pickup

Large Premium SUV

Large SUV

Midsize Pickup

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

Brands Intended to be Profiled in the 2024 Study:

BFGoodrich

Bridgestone

Continental

Cooper

Dunlop

Falken

Firestone

General

Giti

Goodyear

Hankook

Kumho

Michelin

Nexen

Nitto

Pirelli

Toyo

Vogue

Yokohama

(Updated 3/6/2024)

The J.D. Power Component Quality Reports (CQRs) provide global automotive intelligence to an extensive client base of vehicle manufacturers, component suppliers and technology companies. Customized component quality and dependability reports offer component-level data and analytical tools geared to organizational job functions, covering the following components:

2024 Key Dates:

Survey Fielded: July 2023 - May 2024

ADAS

Publish: October 2, 2024

Press Release: October 3, 2024

Driving Experience & Brake

Publish: October 16, 2024

Press Release: N/A

Powertrain

Publish: October 9, 2024

Press Release: N/A

Interior

Publish: August 8, 2024

Press Release: N/A

Multimedia

Publish: September 11, 2024

Press Release: September 12, 2024

Seat

Publish: August 14, 2024

Press Release: August 15, 2024

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will earn a J.D. Power Award.

(Updated 12/05/23)

The J.D. Power Component Dependability Reports are derived from the J.D. Power U.S. Vehicle Dependability StudySM (VDS), data and Excel-based tools. These reports are used to examine, in detail, specific problems experienced and components replaced by original owners of 3-year-old vehicles in the following categories:

2024 Key Dates:

Survey Fielded: August - November 2023

Driving Experience & Brake

Publish: March 21, 2024

Press Release: N/A

Powertrain

Publish: March 14, 2024

Press Release: N/A

HVAC

Publish: March 2024

Press Release: N/A

Interior

Publish: March 2024

Press Release: N/A

Multimedia

Publish: March 2024

Press Release: N/A

Seat

Publish: March 7, 2024

Press Release: N/A

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will earn a J.D. Power Award.

(Updated 12/05/23)

The J.D. Power New Autoshopper Study (NAS) is a comprehensive analysis of automotive consumer shopping patterns across the traditional Internet, mobile Internet, and mobile apps. The study examines how shoppers use digital automotive information during their new vehicle shopping process.

2024 Key Dates:

Fielding: June - September 2024

Client Publish: October 22, 2024

(Updated 12/05/2023)

The J.D. Power ALG Residual Value Awards (RVAs) recognize automakers' outstanding achievements for vehicles that are forecasted by ALG’s proprietary model to hold the highest percentage of their Manufacturer’s Suggested Retail Price (MSRP).

A residual value is the forecasted amount a vehicle will be worth at a certain point over the next six years and is primarily used to calculate the value of the vehicle at the end of a lease agreement. Residual values are a key indicator of an automaker’s success and help determine the overall desirability of automotive brands and their vehicles.

2023 model year vehicles available in the U.S. that have been included in the most recent ALG Edition are eligible to earn a J.D. Power ALG Residual Value Award. Award winners are determined through careful analysis of used vehicle performance of prior year models, brand outlook and product competitiveness. The forecast model uses a wide variety of macro, industry, segment and vehicle factors to arrive at the most accurate prediction of a vehicle’s future value.

Eligibility for an overall brand award in either the Mass Market or Premium category requires a brand to have vehicles in at least four unique model level segments. Overall brand awards are based on the weighted average score for all vehicles sold by the winning brand.

2024 Key Dates:

Press Release: November 2024

Read the 2024 ALG Press Release >

Press Release & Award Information: J.D. Power will issue a national press release that will highlight key findings and trends from the study and awards will be presented in the following categories for the vehicles that hold the highest percentage of their Manufacturer’s Suggested Retail Price (MSRP) and meet J.D. Power’s predetermined research criteria. Each award-recognized brand and model will have the opportunity to promote their performance publicly through the J.D. Power Awards Program.

(Updated 12/05/23)

The J.D. Power U.S. Mobility Confidence Index (MCI) Study, conducted in collaboration with MIT Advanced Vehicle Technology Consortium, provides insight into consumer attitudes, experience, knowledge and acceptance of fully automated, self-driving vehicles from 3,000+ vehicle owners probed across multiple transportation modalities including personal vehicles, public transit and commercial vehicles.

2024 Key Dates:

Client Publish: October 2024

Press Release: October 2024

(Updated 1/22/2024)

The J.D. Power U.S. Robotaxi Experience Study provides insight into consumer attitudes, experience, knowledge and acceptance of robotaxis by aggregating satisfaction and concerns from riders and non-riders.

2024 Key Dates:

Client Publish: October 2024

Press Release: October 2024

Read the 2023 Robotaxi Press Release >

(Updated 4/04/2024)

The Canada Electric Vehicle Consideration (EVC) Study helps automakers and industry players understand shoppers’ ever-evolving perspectives on EVs. Who’s considering EVs? Who’s not? Why?

2024 Key Dates:

Survey Fielded: April - May 2024

Publish: May 29, 2024

Press Release: May 30, 2024

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

The Canada Customer Service Index Long Term (CSI-LT) Study examines customer satisfaction with maintenance and repair services at new-vehicle dealerships, as well as in the automotive aftermarket.

2024 Key Dates:

Survey Fielded: April - June 2024

Publish: September 5, 2024

Press Release: September 5, 2024

Press Release & Award Information: J.D. Power issues national press releases highlighting key findings and top-to-bottom rankings from award-eligible studies. The brand(s) that rank highest in each award-eligible segment and meet predetermined award criteria will have the opportunity to enter into a licensing agreement through the J.D. Power Awards Program, which requires subscribing to the study as a prerequisite. Learn more

For CSI-LT, J.D. Power will present an award to the dealership and aftermarket providers that rank highest in overall customer satisfaction. Awarded providers that subscribe to the Study will also have the opportunity to leverage their award publicly in advertising and marketing through the J.D. Power Award Licensing Program. Award claims will be worded as follows:

#1 in Customer Satisfaction for Dealer Service

#1 in Customer Satisfaction for Aftermarket Service

Brands that rank above the industry average for their segment and subscribe to the study earn the opportunity to commission a J.D. Power Performance Report. J.D. Power Performance Reports are customized, client-commissioned reports that highlight above-average performance by companies in J.D. Power syndicated studies. Each report is written and designed by J.D. Power, and features research findings and charts from the study, with a focus on sponsoring client's ranking and performance. Learn more

The J.D. Power ALG Residual Value Awards (RVAs) recognize automakers' outstanding achievements for vehicles that are forecasted by ALG’s proprietary model to hold the highest percentage of their Manufacturer’s Suggested Retail Price (MSRP).

2024 Key Dates:

Press Release: February 2, 2024

Press Release & Award Information: J.D. Power will issue a national press release that will highlight key findings and trends from the study and awards will be presented in the following categories for the vehicles that hold the highest percentage of their Manufacturer’s Suggested Retail Price (MSRP) and meet J.D. Power’s predetermined research criteria. Each award-recognized brand and model will have the opportunity to promote their performance publicly through the J.D. Power Awards Program.

(Updated 1/03/24)

The Mexico Vehicle Dependability Study (VDS) evaluates the quality and dependability of vehicles during the first three years. Owners are asked to report any problems that they have experienced with their vehicle.

2024 Key Dates:

Survey Fielded: November 2023 - July 2024

Publish: October 24, 2024

Press Release: October 24, 2024

View 2024 Vehicles Profiled by Segment >

The Mexico Automotive Performance, Execution and Layout (APEAL) Study provides marketers and product planners with a concise information tool to gauge which features and attributes make vehicle models stand out to their owners.

2024 Key Dates:

Survey Fielded: November 2023 - July 2024

Publish: October 24, 2024

Press Release: October 24, 2024

The Mexico Sales Satisfaction Index (SSI) Study offers a complete perspective on sales experience, including Digital Retail, product presentation, negotiation and delivery. Analysis includes customers’ satisfaction with the online, sales and delivery experience. SSI includes feedback from both buyers and rejecters.

2024 Key Dates:

Survey Fielded: November 2023 - March 2024

Publish: May 24, 2024

Press Release: May 24, 2024

2024 Profiled Brands:

Mass Market

Changan

Chevrolet

Chirey

Dodge

Fiat

Ford

Honda

Hyundai

JAC

Jeep

KIA

Mazda

MG Motor

Mitsubishi

Nissan

Omoda

Peugeot

RAM

Renault

SEAT

Suzuki

Toyota

Volkswagen

Premium

Audi

BMW

GMC

Mercedes-Benz

The Mexico Customer Service Index (CSI) Study is conducted among customers who provide feedback on their service experience, including facility, service quality, service initiation and delivery, and service advisor. CSI includes the role of technology in the service experience.

2024 Key Dates:

Survey Fielded: November 2023 - July 2024

Publish: September 12, 2024

Press Release: September 12, 2024

2024 Profiled Brands:

Mass Market

Chevrolet

Dodge

Fiat

Ford

Honda

Hyundai

JAC

Jeep

KIA

Mazda

MG

Mitsubishi

Nissan

Peugeot

RAM

Renault

SEAT

Suzuki

Toyota

Volkswagen

Premium

Audi

BMW

GMC

Mercedes-Benz

MINI

Volvo

(Updated 3/28/24)

The China Initial Quality Study (IQS) contains comprehensive and analytically rich information to help manufacturers understand product quality issues.

2024 Key Dates:

Survey Fielded: December 2023 - March 2024

Publish: September 2024

Press Release: September 2024

The China Vehicle Dependability Study (VDS) evaluates the quality and dependability of vehicles during the first three years. Owners are asked to report any problems that they have experienced with their vehicle.

2024 Key Dates:

Survey Fielded: February - July 2024

Publish: October 2024

Press Release: October 2024

The China Automotive Performance, Execution and Layout (APEAL) Study provides marketers and product planners with a concise information tool to gauge which features and attributes make vehicle models stand out to their owners.

2024 Key Dates:

Survey Fielded: December 2023 - March 2024

Publish: August 2024

Press Release: August 2024

The China Tech Experience Index (TXI) Study measures problems encountered and the user experience with advanced technologies as they first enter the market.

2024 Key Dates:

NEV Survey Fielded: December 2023 - March 2024

ICEV Survey Fielded: December 2023 - May 2024

Publish: August 2024

Press Release: August 2024

The China New Energy Vehicle Initial Quality Study (NEV-IQS) measures consumer-reported problems in the first three months of new energy vehicle ownership.

2024 Key Dates:

Survey Fielded: December 2023 - March 2024

Publish: June 2024

Press Release: June 2024

The China New Energy Vehicle Automotive Performance, Execution and Layout (NEV-APEAL) Study measures the consumer experience with the vehicle during the first three months of new energy vehicle ownership.

2024 Key Dates:

Survey Fielded: December 2023 - March 2024

Publish: May 2024

Press Release: May 2024

The China New Energy Vehicle Customer Experience Value Index [NEV-CXVI] Study focuses on the performances of NEV customer experience values among brands throughout the whole journey. It uses a Customer Experience Value Index (CXVI) to evaluate the overall performances of automotive OEMs in

terms of customer experience. Focusing on

the exploration of specific actions to satisfy

customers’ needs under a variety of experience scenarios, the study is designed to lead the industry to continuously build a more efficient and customer-oriented experience framework

2024 Key Dates:

Survey Fielded: April - June 2024

Publish: August 2024

Press Release: August 2024

The China Sales Satisfaction Index (SSI) Study offers a complete perspective on new energy vehicle's sales experience, including digital retail, product presentation, negotiation and delivery.

2024 Key Dates:

Survey Fielded: December 2023 - May 2024

Publish: August 2024

Press Release: August 2024

The China Customer Service Index (CSI) Study is conducted among customers who provide feedback on their service experience, including facility, service quality, service initiation and delivery, and service advisor. CSI includes the role of technology in the service experience.

2024 Key Dates:

Survey Fielded: February - July 2024

Publish: September 2024

Press Release: September 2024

The Japan Initial Quality Study (IQS) contains comprehensive and analytically rich information to help manufacturers understand product quality issues.

2024 Key Dates:

Survey Fielded: May - June 2024

Publish: September 2024

Press Release: September 2024

The Japan Automotive Performance, Execution and Layout (APEAL) Study provides marketers and product planners with a concise information tool to gauge which features and attributes make vehicle models stand out to their owners.

2024 Key Dates:

Survey Fielded: May - June 2024

Publish: October 2024

Press Release: October 2024

The Japan Tech Experience Index (TXI) Study measures problems encountered and the user experience with advanced technologies as they first enter the market.

2024 Key Dates:

Survey Fielded: May - June 2024

Publish: November 2024

Press Release: November 2024

The Japan Sales Satisfaction Index (SSI) Study offers a complete perspective on sales experience, including Digital Retail, product presentation, negotiation and delivery. Analysis includes customers’ satisfaction with the online, sales and delivery experience. SSI includes feedback from both buyers and rejecters.

2024 Key Dates:

Survey Fielded: May - June 2024

Publish: August 2024

Press Release: August 2024

The Japan Customer Service Index (CSI) Study is conducted among customers who provide feedback on their service experience, including facility, service quality, service initiation and delivery, and service advisor. CSI includes the role of technology in the service experience.

2024 Key Dates:

Survey Fielded: May - June 2024

Publish: August 2024

Press Release: August 2024

2024 Key Dates:

Survey Fielded: July - August 2024

Publish: December 2024

Press Release: December 2024

The Japan Used Vehicle Sales Satisfaction Index (UVSSI) Study offers a comprehensive view of consumer satisfaction with the purchase experience of used vehicles. UVSSI provides in-depth analysis of how consumers perceive used vehicle dealerships based on purchase experiences such as shopping-around, negotiation, contract and delivery. The study also analyzes consumers’ purchase behaviors and how they select the dealership where they purchase their vehicle.

2024 Key Dates:

Survey Fielded: June - July 2024

Publish: September 2024

Press Release: September 2024

The Japan Electric Vehicle Electric Vehicle Experience (EVX) Ownership Study sets the standard for benchmarking EV owner satisfaction with the critical attributes that affect the EV ownership experience. From the cost of ownership, problems experienced, vehicle service experience to driving habits and range, and ease of charging, this study provides a comprehensive assessment of consumer experiences with their with battery electric and plug-in hybrid electric vehicles. These experiences will strongly affect owners’ likelihood to repurchase an EV and recommend an EV to others. These key behaviors and insights into current EV ownership will help OEMs assess where they rank, who is doing it best, and why.

(Updated 4/2/24)